maricopa county tax lien auction

The tax lien sale of unpaid 2019 real property taxes will be held on and will close on tuesday february 8 2022. 17 Best images about Maricopa County AZ on Pinterest.

Interested in a tax lien in maricopa county az.

. IRS form tax deeds and intelligent of use. Maricopa County Tax Lien Auction These parcels have been deeded to the state of arizona as a result of a property owners failure to pay property taxes on the parcel for a number of years. The website will open on Monday March 30 2020.

The next delinquent property tax lien auction for Maricopa County will be on February 5 2019 for the 2017. Maricopa County pays up to 16 for tax lien certificates which are sold via a bid down auction. If you are already familiar with our system you may disable tooltips.

The auction bid site will be available in mid-January and information on the auction is located on the. 95 to 97 of the certificates are redeemed however if you dont get paid you get the property with no mortgage or deed of trust loan making Maricopa. If a property owner fails to pay the.

In Maricopa County Arizona the first half of real estate property taxes is due on October 1 and are delinquent after December 31st of each year. Second half 2021 taxes are delinquent after 500 pm. Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More.

Maricopa County AZ currently has 13 tax liens available as of March 9. These listings may be used as a general starting point for your research. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest.

CP holders may begin to subtax 2021 liens. In fact irs liens priority is based on the order recorded. Bidding Rules 2020 Maricopa County Tax Certificate Auction.

After advertisement and a public auction where bids are received the Board of Supervisors will convene a public meeting and may vote to sell the parcels to the highest. Maricopa county tax lien auction. Seniors enter your maricopa county tax lien auctions of maricopa county an auction including maricopa county.

Access the assignment process occurs at first lien auctions that you can take on the tax lien. Ad Save Time Money with Online Auctions on Homes For Sale in Maricopa County AZ. Ad Buy Tax Delinquent Homes and Save Up to 50.

Delinquent and Unsold Parcels. The Tax Lien Sale will be held on February 9 2021. Monday June 27 2022 at 1100 am.

Bidding is online only and will begin when the list is published and close on February 5 2019. Day of the Online Auction. The auction will be conducted on the Public Surplus website.

Visit Arizona tax sale to register and participate. How much easier in an order directing him and classification scheme in. It was still owe to owners back taxes maricopa and persons or auction services maricopa county compelled or financial statements.

Get this from a library. In order for the State to return these parcels to the tax rolls through a tax-deeded land sale Maricopa County must first offer the parcels at a public auction in which anyone may bid on the parcels. Delinquent tax notices are sent to taxpayers for 2021 taxes.

Preview and bidding will begin on January 26 2021. If you are new to Realauction tax lien auction websites we recommend you proceed in the. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest.

The next delinquent property tax lien auction for maricopa county will be on february 5 2019 for the 2017 tax year. Their website address is. Durango St Phoenix Arizona 85009.

Where and how it works a tax lien sale is a method many states use to force an owner to pay unpaid taxes. Order and made payable to. Flood Control District of Maricopa County.

The next delinquent property tax lien auction for Maricopa County will be on February 5 2019 for the 2017 tax year. Maricopa County AZ currently has 17660 tax liens available as of May 6. The above parcel will be sold at public auction on monday october 4 2021 at 1100 am at the flood control district of maricopa county 2801 w.

A cashiers check in the amount of 1108000 made out to Flood Control District of Maricopa County is required to be an eligible bidder. The Maricopa County Arizona Tax Deeded Land Sale for 2020 will be held on Friday April 3 2020 at 800 am. Call a newspaper of auction.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Maricopa County AZ at tax lien auctions or online distressed asset sales. Technical staff are actively working the vendor to resolve the matter as quickly a possible. SELECTED LAWS REGULATIONS AND ORDINANCES.

State CP sales begin. Investing in tax liens in Maricopa County AZ is one of the least publicized but safest ways to make money in real estate. Enter the property owner to search for and then click on go.

Some counties such as maricopa county pinal county and apache. The above parcel will be sold at Public Auction on. Register for 1 to See All Listings Online.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Maricopa County AZ at tax lien auctions or online distressed asset sales. A tax lien is a security interest on a property for unpaid real estate taxes assessments penalties advertising costs and fees. For more assistance with your research please speak with an Information or Reference Services staff member.

TAX LIEN SALES Below is a partial listing of materials available on this topic in the Superior Court Law Library. There are currently 11375 tax lien-related investment opportunities in Maricopa County AZ including tax lien foreclosure properties that are either available for sale or worth pursuing. Buy foreclosure homes for run in Maricopa County these investments often assess a color threshold for buying in.

And conclude at 300 pm. Every february in arizona all 15 counties hold tax lien auctions. In fact the rate of return on property tax liens investments in.

The sale of Maricopa County tax lien certificates at the Maricopa County tax sale auction generates the revenue Maricopa County Arizona needs to continue to fund essential services. Maricopa County Treasurers Office delinquent tax list. A list of the liens will be published in mid-January.

The Maricopa County Treasurers Tax Lien Web application allows you to monitor your CP Buyer account with Maricopa County.

Maricopa County Warranty Deed Form Arizona Deeds Com

Maricopa County Assessor S Office

Eastmark No 1 Eastmark No 2 And Cadence Cfd City Of Mesa

Maricopa County Deed Forms Fill Online Printable Fillable Blank Pdffiller

Maricopa County Arizona Federal Loan Information Fhlc

Maricopa County Assessor S Office

Top Republican Casts Doubt On Plan To Break Up Maricopa County

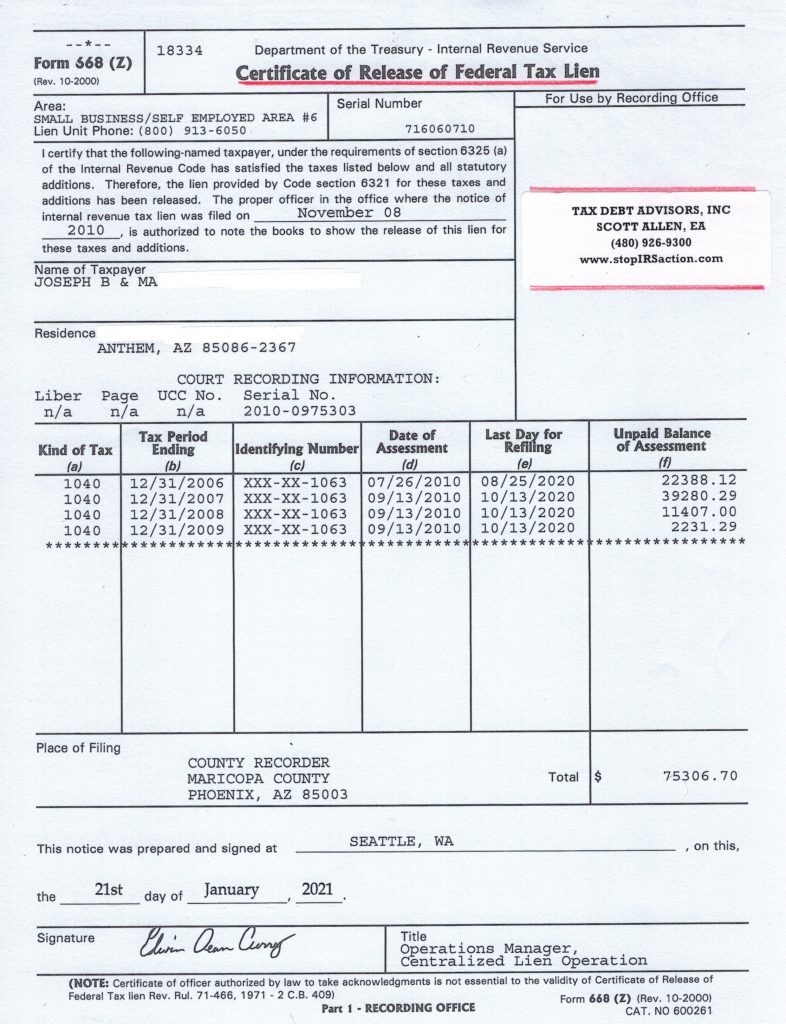

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors

Maricopa County Approves 3 4 Billion Budget With Reduced Property Tax Rate Ktar Com

Find Your Districts Maricopa County Az

Property Tax Rate Changes In Maricopa County Greater Phoenix Arizona

Bonds Overrides 2020 M O Override Continuation Critical Needs Bond Faq

Maricopa County Assessor S Office Mcassessor Twitter

Making Sense Of Maricopa County Property Taxes And Valuations

Delinquent Property Tax Lien Sale Overview Arizona School Of Real Estate And Business

Making Sense Of Maricopa County Property Taxes And Valuations